Is MSTY YieldMax II ETF Worth It? June–July 2025 Performance Breakdown

Introduction: High Yield, Higher Stakes

When it comes to ETFs, the MSTY YieldMax II ETF doesn’t play by the usual rules.

It’s not chasing slow and steady growth—it’s swinging for the fences with a high-octane income strategy tied to MicroStrategy (MSTR), the Bitcoin-heavy tech juggernaut. Think of MSTY as a dividend-delivering machine dressed in the high-volatility wardrobe of a leveraged options fund.

But how’s it really performed lately? Between 18 June and 8 July 2025, MSTY went through a short yet eventful run—some minor price dancing, a hefty dividend drop, and a total return that may leave yield-hungry investors grinning.

This blog cuts through the noise. We’re not here to waffle—we’re here to dissect.

We’ll break down how MSTY moved, what drove its returns, and why understanding both capital movement and dividend mechanics is crucial if you’re eyeing this beast for your income portfolio.

What happened to my MSTY holding last month? MSTY ETF: The High-Yield Rollercoaster That Paid Me $20,000 in a Month

Snapshot: Performance at a Glance

Here’s the no-fluff breakdown of how MSTY stacked up over the 3-week period:

And here’s what it all translates to:

📈 Starting Price: $20.55

📉 Ending Price: $20.65

💸 Dividend Paid (2 July): $1.2382

💰 Total Return: +6.51% (Price gain + dividend income)

The price nudged up just 0.49%, but the dividend did the heavy lifting. That’s the secret sauce of MSTY—it’s less about watching the chart spike, more about collecting juicy cheques.

Price Performance Breakdown

Let’s talk movement. From June 18 to July 7, MSTY kept traders on their toes.

· The ETF opened at $20.55 on 18 June—a modest start.

· On 30 June, it hit a short-term peak of $22.17, marking a 7.9% jump from the starting line. That spike? Most likely fuelled by MicroStrategy's price rally, a frequent driver given MSTY’s dependency on MSTR's share performance.

· Just two trading days later, on 2 July, the ETF hovered at $22.10—right before dropping its massive monthly dividend.

· But then came the pullback: by 7 July, the price had cooled to $20.65, likely reflecting typical ex-dividend price action and renewed volatility in the crypto and tech space.

This is MSTY in a nutshell: volatile, reactive, and built for yield rather than smooth sailing. The wide swings are the tax you pay for that fat income stream.

I’m 4,700 MSTY Shares Deep with over $37,275 in dividends - My Personal MSTY Strategy (No Telegram Shillers Required)

Let’s get one thing crystal clear:

This is not financial advice.

I’m not your adviser. I’m not your broker. And I’m definitely not that bloke in a Telegram group yelling “BUY THE DIP” at 1am while six beers deep.

What follows is my game plan. My rules. My capital. My tax liability. If it lines up with how you think? Great. But this is just how I personally manage MSTY YieldMax II ETF—tailored to my goals, my risk tolerance, and my desire not to trade like a caffeine-fuelled crypto degen mid bull run.

The system? It’s dead simple:

Set. Stack. Monitor.

Step 1: Set — Lock in the Game Plan

📅 One trade per month. No exceptions.

I don’t chase green candles or try to time the top like I’m auditioning for The Big Short 2. I pick a date—any date—and I stick to it. No second-guessing. No emotional rollcoasters. Just one deliberate entry each month.

🔻 I buy on the ex-date.

That’s the day after the record date. Why? Because MSTY typically drops once the dividend is priced out—giving me a cleaner entry point. It’s like buying the dip... on autopilot.

Result? Less brokerage, less stress, and no mental tail-chasing.

Step 2: Stack — Reinvest Smart, Not Blind

💰 I started with a decent capital base (from a property sale), earmarking around 25%—roughly $100k—for MSTY.

But I didn’t dump it in all at once. I deployed that cash over 2–3 months, because I want dry powder if the market cops a left hook. Going “all-in” upfront is how you end up stuck and cashless when real opportunities show up.

🔁 I reinvest distributions—but with a plan.

Every MSTY payment that hits my account, I immediately pull out 45% for tax. Why? Because MSTY doesn’t come with franking credits. This is raw, assessable income—treated by the ATO like a salary, not a dividend with perks.

Why 45%?

My average tax rate is ~40%, and I throw in a 5% buffer. Future-me likes surprises, but not from the tax office.

📎 Heads-up on Return of Capital (ROC):

Sometimes, part of MSTY’s payout isn’t income at all—it’s Return of Capital. That’s not a bonus. It’s your own money coming back dressed up in a tuxedo. It reduces your cost base and increases your capital gains tax when you sell. Delayed pain, not free lunch.

Step 3: Monitor — Don’t Sleep on the Risk

This isn’t a sleepy ETF that sips tea and earns a gentle yield.

It’s more like holding a mechanical bull that throws off dividends while spinning sideways.

🔄 I stagger big positions.

If I’m moving a serious chunk of cash, I split it up. If Bitcoin drops 30% the next day, I want to know I’ve still got ammo left—not just regrets and an empty clip.

🧠 Yes, I’m a Bitcoin maxi.

Which means I’m structurally bullish on MicroStrategy (MSTR)—and by extension, MSTY. But being bullish doesn’t mean going blind. I know damn well this strategy can get smashed if MSTR or BTC nosedives.

Why do I back Bitcoin? Simple: it’s the hardest money on Earth.

Want a primer? Watch a couple of Michael Saylor interviews and see if you don’t walk away either fired up… or shopping for a cold wallet.

📉 Capital gains are capped.

That’s the fine print with covered call ETFs. You’re trading upside potential for income certainty. If MSTR moons, MSTY might crawl. You’ll still collect your premiums—but you won’t ride the full wave. It’s a cashflow-first trade-off.

If this all sounds a bit too much like work, MSTY may not be your thing. But if you’re chasing serious yield with eyes wide open? It can be a powerful addition to the portfolio—so long as you treat it like a strategy, not a gamble.

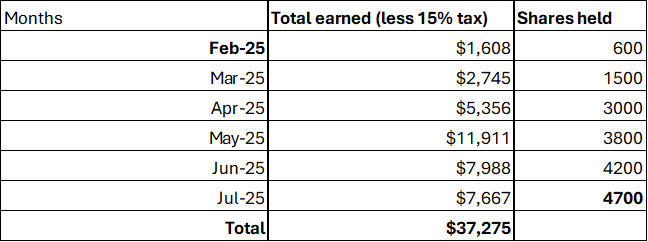

My current MSTY holdings

Let’s inspect my MSTY distributions so far..

So total income looks like...

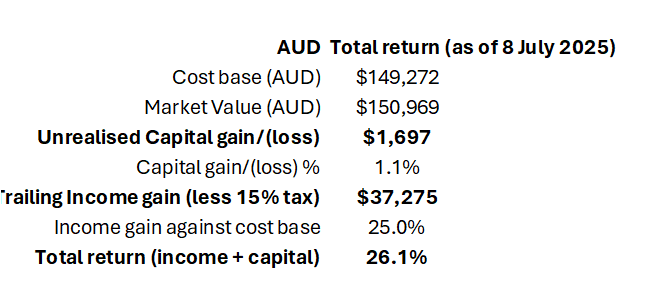

Now that all my numbers are laid bare, for the world to see, what does the total return look like?

How about comparing to how it performed vs last month? Read here

4. The Power of the Dividend

Let’s not sugar-coat it—MSTY’s price barely budged over the review period. A measly $0.10 price gain isn’t exactly poster-worthy. But then came the dividend. On 2 July, MSTY dropped a $1.2382 per share payout—an eye-watering return by ETF standards.

To put that in perspective: the dividend alone delivered 6%+ of the total return, making it the real MVP in this story.

And this isn’t just luck or a special event. It’s baked into MSTY’s DNA. The fund runs a covered call income strategy, meaning it earns premiums by selling options on its underlying stock (MicroStrategy). Those premiums, rather than being reinvested, are paid out to unitholders—resulting in regular, high-yield distributions.

But this approach has a trade-off. It caps upside potential and amplifies exposure to volatility. It’s like leasing out your Ferrari every month—you get paid handsomely, but you risk wear and tear. YieldMax ETFs fully lean into that model, prioritising income over capital growth.

Total Return Analysis

Here’s the magic formula:

🔹 Price Return: +0.49%

🔹 Dividend Yield (during period): +6.02%

🔹 Total Return: +6.51%

In just 3 weeks, that’s a hefty return—especially when most traditional ETFs spend a full year trying to touch 6%. For example, stalwarts like Vanguard’s VHY or SPDR’s SYI typically yield 4–6% annually, not monthly. Even the high-octane JEPI ETF from JPMorgan is usually in the 1–1.5% monthly range, depending on volatility and options income.

So, who should care?

👉 Income-focused investors: retirees, cashflow-hungry punters, or dividend fiends tired of waiting quarterly for crumbs.

👉 Short-term traders: willing to dance with volatility for a quick yield hit.

Just don’t expect stability. MSTY isn't for the faint-hearted—it’s for investors who understand the game and are happy to pocket the income while riding the rollercoaster.

Key Data Table: MSTY Daily Tracking

Here’s the day-by-day rundown so you can see the moves for yourself:

📌 Note: The price drop post-dividend is standard—markets typically adjust the share price downward after a dividend is paid, reflecting the cash leaving the fund.

Risks and Volatility

Let’s not pretend MSTY is a set-and-forget blue-chip fund. This is a high-yield ETF stapled to a high-volatility stock—and the past few weeks showed it.

Between 18 June and 30 June, the ETF rallied nearly 7.9%, only to retreat sharply by 7 July. That swing alone should raise an eyebrow.

Why so jumpy? Two words: MicroStrategy exposure.

MSTY isn’t diversified—it’s tethered to MSTR, which itself is often a proxy for Bitcoin sentiment. Layer on a covered call strategy, and you’re stacking leverage on top of leverage. If MSTR rips higher, the ETF misses some upside (calls are exercised). If MSTR tumbles, the ETF cops the downside like any equity.

Add in the monthly yield expectation, and this is no "safety-first" investment. The dividends are attractive, but they’re funded by selling away future potential—and that’s a dance with risk.

⚠️ In short: High yield = High exposure = High caution.

Investor Takeaways

Here’s the distilled wisdom—no filler, just facts:

· ✅ Strong Income Potential: That $1.23 dividend in July proves the yield engine works when volatility plays nice.

· ⚖️ Modest Capital Gains: Over the period, MSTY’s price barely moved. That’s by design—it trades income for price growth.

· ⚠️ High Volatility, High Risk: If you can’t stomach price drops or don’t understand how options income works, MSTY will test your nerve.

· 🎯 Best For:

o Yield hunters who don’t mind a wild ride

o Tactical traders playing short-term income

o Investors comfortable with MSTR + Bitcoin exposure

MSTY isn’t a long-term "buy the dip and chill" vehicle—it’s more of a yield-focused tactical play for those who know the rules and can handle the heat.

Conclusion

So, what did MSTY deliver in three weeks?

A +6.51% total return, carried almost entirely by its massive July dividend. Price gains were minimal, volatility was ever-present, and the story played out exactly as advertised.

For investors who understand the mechanics—covered calls, MSTR correlation, and the monthly distribution rhythm—MSTY can be a powerful yield engine.

But looking ahead? Watch for:

· MSTR’s next earnings report (because that drives MSTY’s trajectory)

· Bitcoin price action (yes, even if you're not into crypto)

· Market volatility, which impacts how juicy future option premiums will be

In the end, MSTY is for those who trade income like a weapon—not passengers looking for a smooth cruise.

Sources and Further Reading

To go deeper, check the original data and dividend insights from:

· Digrin – Dividend Growth & Income

Frequently Asked Questions (FAQ)

1. What is the MSTY YieldMax II ETF?

MSTY is an exchange-traded fund designed to generate high monthly income by using a covered call strategy on MicroStrategy (MSTR) stock. It aims to deliver outsized yields by collecting option premiums while limiting upside growth potential.

2. How did MSTY perform between 18 June and 8 July 2025?

Over this period, MSTY delivered a +6.51% total return, driven mostly by a $1.2382 dividend paid on 2 July. The ETF’s share price remained relatively flat, moving from $20.55 to $20.65.

3. Why is MSTY’s dividend so high?

The fund earns income by selling call options on MSTR shares. The premiums collected are distributed as dividends. This strategy can generate strong income, but it also limits capital appreciation and increases downside risk.

4. What are the risks of investing in MSTY?

MSTY is highly volatile due to its dependence on MicroStrategy’s stock price, which is closely tied to Bitcoin movements. Investors also face risks associated with options strategies and capital erosion in turbulent markets.

5. Is MSTY suitable for long-term investing?

MSTY is best suited for income-focused investors who understand the trade-offs of high-yield, high-risk ETFs. It’s not ideal for passive, long-term growth investors due to its capped upside and exposure to volatile underlying assets.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

Join our Facebook Community - https://www.facebook.com/armchairbanker

Or join our Reddit Community - https://www.reddit.com/r/ArmchairInvestor/

X - https://x.com/armchairbankr

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights on.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.