July 10, 2025 to Today: Bitcoin’s Performance Explained + My Trade Recommendation

Check out June’s BTC recap -> Bitcoin’s Wild June 2025: Did You Miss These Game-Changing Events?

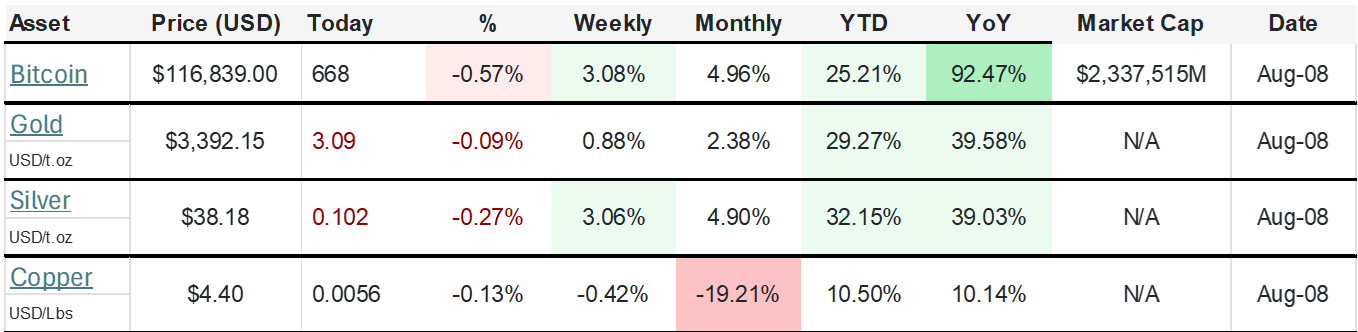

Looks like early August is looking bullish! But am I recommending to buy, sell or hold? Find out below.

I. Introduction

On 10 July 2025 Bitcoin opened at about $111,327. By late July it was pressing against the US$120,000 ceiling, a level that had traders salivating and short sellers quietly reaching for aspirin.

Early August brought a sensible cooldown to roughly US$115,022, a reminder that even the strongest rallies take a breather. The next move matters: is this a buying opportunity, a time to lock in profits, or simply a moment to hold and let the market do the heavy lifting?

II. Bitcoin Price Performance

On 10 July Bitcoin traded around $111,327. By 7 August it had risen to about $115,022, having tested the US$120,000 mark in late July.

August saw a pullback of roughly 6 to 7 per cent, driven by profit taking rather than structural weakness, with the price now holding firm above $114,000. In trading psychology, this kind of consolidation often shakes out the impatient and rewards those who understand that momentum builds in waves.

III. US Federal & State Legislation

Policy has been a tailwind rather than an anchor. On 18 July the GENIUS Act became law, providing long overdue clarity on stablecoin oversight and boosting institutional confidence in digital assets.

The White House followed with a rare pro-market pivot, shifting from enforcement-heavy tactics to explicit rulemaking. At the same time, several states have been cementing custody rules that match the new federal framework, giving investors fewer regulatory shadows to worry about and more reason to keep capital in play.

IV. M2 Money Supply Growth & Monetary Policy

Liquidity is the oxygen of asset markets, and the US has just turned up the flow. M2 money supply hit $22 trillion in June, up 4.5 per cent year on year, the fastest expansion since July 2022. In plain English, there is more money chasing the same assets, and Bitcoin thrives in that kind of environment.

The Federal Reserve kept rates steady, but the market is already betting on cuts before year end. If those expectations are met, the cost of capital drops, risk appetite rises, and assets like Bitcoin tend to climb the wall of worry.

V. Adoption & Usage Trends

Early August brought whispers that US retirement accounts such as 401(k)s and IRAs could soon hold significant digital asset allocations. The rumour alone lifted Bitcoin about 3 per cent, proof that access matters. On the institutional front, the US spot Bitcoin ETF market has grown to $110 billion and public companies continue adding Bitcoin to their treasuries source. Each of these moves chips away at Bitcoin’s old reputation as a fringe asset and cements it as a mainstream store of value.

VI. ETF Flows & Market Cap

Even strong trends pause for breath. Early August saw US$643 million in ETF outflows, ending a seven-week run of inflows.

A week later, on 6 August, there was a US$91.55 million inflow as talk of rate cuts renewed optimism. Market capitalisation has eased from $4 trillion at the July peak to about $3.67 trillion. For long-term investors, that is often the kind of pullback that clears the air and resets the stage for the next leg higher.

VII. Sentiment – Crypto Fear & Greed Index

The Fear and Greed Index sits at 74, firmly in “Greed” territory, up 12 points overnight. It reflects strong conviction among investors and traders, but markets with this much confidence can become fragile.

Greed often inflates prices faster than fundamentals, and when reality checks in, corrections can be sharp. Seasoned investors treat readings like this as both an opportunity and a warning.

VIII. Network Health – Bitcoin Hash Rate

The hash rate is at 913.5 million terahashes per second, up 44.8 per cent year on year source.

That level of computing power signals a network that is secure and well backed by miners who are confident in the long-term price. The flip side is that maintaining this record capacity comes with higher operational costs, which require a healthy Bitcoin price to remain sustainable.

IX. Broader Macroeconomic Drivers

The early August slide was less about fundamental weakness and more about profit taking after a strong July rally source.

Weak US jobs data briefly weighed on sentiment, though expectations for Fed easing provided support. On a global scale, the continued expansion of liquidity remains a tailwind, reinforcing Bitcoin’s role as a hedge against currency debasement and inflation.

X. My Trade Recommendation – HOLD, but DCA – Dollar Cost Average (Bullish Bias) - Opinion only

Positives

• Clearer policy and legislation

• Expanding M2 and possible Fed rate cuts

• Growing adoption through ETFs and retirement plans

• Record hash rate and network security

• Broad optimism across the market

Risks

• Elevated greed levels in sentiment indicators

• Short-term swings from profit taking

• Sensitivity to macroeconomic surprises

Guidance: For those already positioned, holding remains the more rational choice given the supportive backdrop. For new entrants, discipline is essential. High prices and elevated sentiment require careful sizing and a willingness to ride out volatility source.

XI. Conclusion

From 10 July to 8 August 2025 Bitcoin climbed from $111,327 to $115,022, touched $120,000, and absorbed a healthy correction. Liquidity growth, adoption momentum, policy clarity, and a robust network all point toward continued strength. For now, the smarter play is to hold, keep risk in check, and let the fundamentals do their work.

Frequently Asked Questions

1. Why did Bitcoin pull back in early August 2025?

The drop of about 6 to 7 per cent was largely profit taking after a strong run through July. It was more of a healthy exhale than a loss of confidence, with prices stabilising above $114,000.

2. How significant is the GENIUS Act for Bitcoin investors?

The GENIUS Act provided clear stablecoin oversight for the first time in the US. This regulatory clarity boosted institutional trust in digital assets, which helped push Bitcoin to record highs.

3. Does the current “Greed” reading mean a crash is coming?

Not necessarily. The Fear and Greed Index at 74 signals strong optimism, but extreme greed can precede corrections. It’s a reminder to manage risk, not an automatic sell signal.

4. How important is the rising hash rate?

The hash rate near all-time highs shows strong network security and miner confidence. It’s a long-term positive, although it comes with higher operational costs that rely on healthy Bitcoin prices.

5. Should I buy Bitcoin now?

The current stance is HOLD with a bullish bias. Existing holders can stay the course, while new buyers should size positions carefully and be prepared for short-term swings source.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

Or join our Reddit Community - https://www.reddit.com/r/ArmchairInvestor/

X - https://x.com/armchairbankr

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights on and keep providing you with the best financial content.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.