MSTY Risks and my $21,448 gain, what’s next?

If you're curious about how high-yield ETFs can deliver jaw-dropping short-term returns—with a healthy side of stomach-churning risk—I recently shared how the MSTY ETF paid me over $20,000 in a month. It’s a wild ride powered by Bitcoin volatility and MicroStrategy exposure. Read the full breakdown here.

Introduction: High Yield or Hidden Trap?

Let’s get one thing straight—MSTY isn’t your typical sleepy ETF parked next to your grandma’s Telstra shares. The YieldMax MSTY ETF is a high-octane, income-hunting machine tied directly to the wild, bitcoin-fuelled rollercoaster known as MicroStrategy (MSTR).

You know, the company that hoards Bitcoin like it's prepping for the financial apocalypse? Yeah mate, that one.

Now, why are investors glued to MSTY in 2025?

Because it’s flashing a dividend yield of 123.06%, and yes, that number is real—not a typo, not a Ponzi, not a prank. Combine that with a +25.42% year-to-date return, and you’ve got punters foaming at the mouth like it’s 2021 all over again.

But behind every seductive yield is a set of teeth. And MSTY’s bite can hurt.

So, what’s this article about? Simple. We're breaking down:

· The shiny performance numbers (spoiler: they're impressive).

· Share my personal MSTY strategy along with current holdings and return

· The hidden landmines buried beneath the surface, the MSTY Risks (scary)

· Whether this ETF is a cash cow or a financial Venus flytrap.

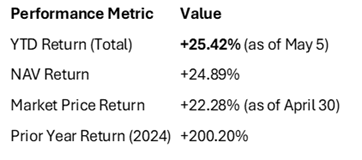

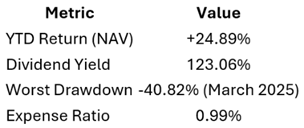

MSTY Yieldmax ETF - 2025 YTD Performance at a Glance

The headline? MSTY has returned +25.42% YTD as of May 5, 2025. That’s after it pulled a jaw-dropping +200.20% return in 2024—the kind of number that makes even the most jaded investor raise an eyebrow and double-check their brokerage login.

But let’s zoom in on the details:

The ETF’s Net Asset Value (NAV) returned +24.89%, which is just shy of the total return, suggesting tight tracking of its core assets.

Meanwhile, the market price lagged a touch at +22.28%, hinting at slight discounts or market skittishness. Still, the returns are leagues ahead of most traditional yield strategies, making MSTY a standout—at least on paper.

But remember: high flyers have the furthest to fall. And MSTY’s strategy is built on a foundation that’s part options theatre, part Bitcoin drama, and entirely unhedged.

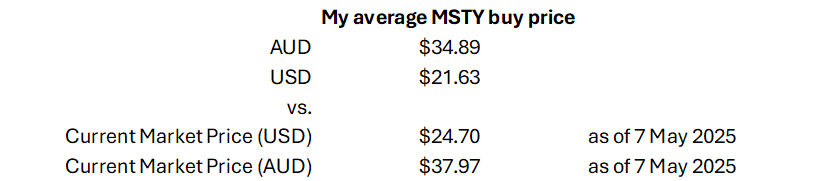

I’m 3,800 MSTY shares deep, how’s it looking so far?

My MSTY Strategy (Not Advice, Just What I Do)

Let’s be clear—this is not financial advice. It’s not a recommendation. It’s not a “hot tip” whispered behind a trading desk in Barangaroo.

What you’re about to read is my personal strategy—nothing more, nothing less. It’s how I approach MSTY in a way that makes sense for me, my goals, and my risk profile.

The formula? Simple. I call it: Set, Stack, and Monitor.

Step 1: Set – Lock in the Game Plan

- One trade per month. That’s it. No overtrading, no FOMO-fuelled intraday scalping.

One clear, premeditated purchase every month saves me brokerage fees, decision fatigue, and “what-if” anxiety. - Buy on the ex-date. This one’s crucial. I wait until the day after the record date (the ex-dividend date) to make my purchase. Why? Because the unit price often drops post-dividend, giving me a cleaner entry and a more efficient dollar-cost average.

Step 2: Stack – Reinvest Smart, Not Blind

- I start with an initial capital base, then reinvest future distributions into more MSTY. No chasing. No overleveraging. Just compounding.

o Here’s a real example, I sold a property and used 25% of the total proceeds as my ‘initial capital base’, call it $100K.

o That $100K I used over 2-3 months, so incase of a market wide shock then I still have ammo to buy more. If I use the $100k off the bat, and the market suffers well I’m at a disadvantage because all my capital was used.

- But—and this is critical—I always slice off a chunk for tax.

My rule?

If I receive a distribution, I immediately set aside 45% for the tax man.

Why 45%? My average tax rate is 40%, and I add a conservative 5% buffer because MSTY distributions are likely fully assessable income. No franking credits. No free rides.

(Pro tip: have a quick yarn with your accountant. You’ll thank yourself at tax time.)

· A key quirk in MSTY’s juicy yield is its use of Return of Capital (ROC)—which isn’t a bonus, but your own money coming back to you, dressed up as a distribution. Since MSTY generates income through selling options (not dividends), some payouts may include ROC to maintain that eye-popping yield. It’s tax-deferred at first (which sounds great), but ROC lowers your cost base, meaning a bigger capital gain tax bill later when you sell. In short: you're not always getting “extra” income—sometimes you're just slowly eating your principal in a tuxedo.

Step 3: Monitor – Don't Sleep on the Risk

MSTY can throw you some wild swings, so I use these risk buffers to stay sane:

- Big capital? Spread it out – mentioned this in step 2. If I’m putting in serious money, I never deploy it all at once. I split entries across multiple months. It cushions systemic risk—like if Bitcoin decides to take a 30% haircut the day after I go all in.

- I’m a Bitcoin maxi, which means I’m structurally bullish on both BTC and MSTR. But bullish doesn’t mean reckless. I know this strategy can get chopped up by volatility. I don’t pretend it’s immune—because it’s not. Why am I BTC maxi? Because it’s the hardest money on the planet, do yourself a favour and checkout some Michael Saylor clips on youtube, you’ll thank me later!

- Capital gains are capped. Remember, this is a covered call ETF. That means there’s upside... but it’s hamstrung. Think: gains on a leash. If MSTR moonshots, MSTY won’t keep pace. That’s the trade-off for that juicy yield.

This isn’t a get-rich-quick scheme. It’s a get-paid-well-while-you-wait strategy. I play the long game, stay disciplined, and never forget that even the sexiest ETFs can bite.

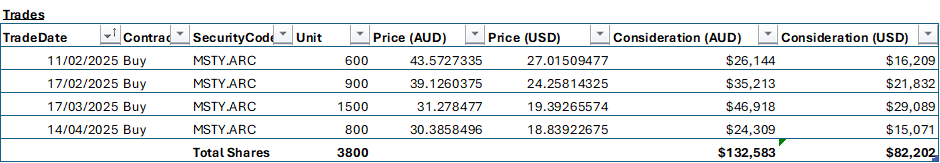

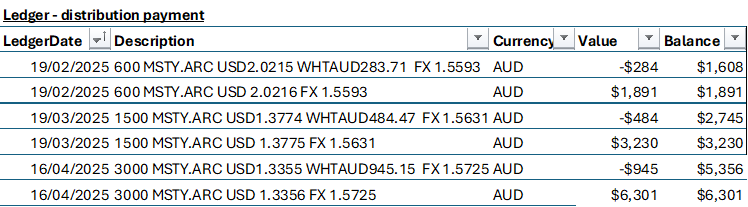

Let’s dive in, we’ll start off with all my trades

Few things to note

· The date is expressed as follows – DAY/MONTH/YEAR. To my American brothers and sisters, why do MONTH/DAY/YEAR… why?

· I bought a small parcel before ex-date, wanted to test the initial distribution or as I say, dip my toe before jumping

Next is looking at the distributions

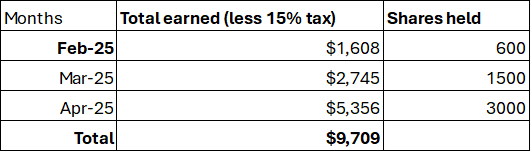

So total income looks like...

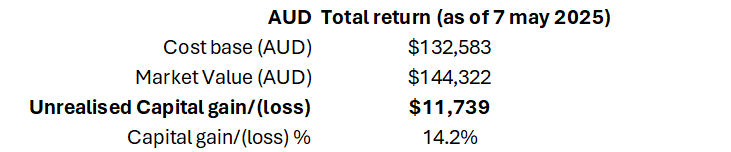

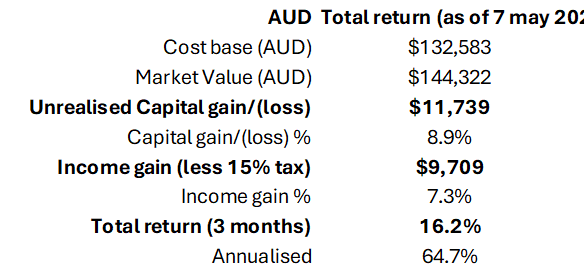

Now that all my numbers are laid bare, for the world to see, what does the total return look like?

Yield Temptation: MSTY' 123.06% Dividend Yield

One hundred and twenty-three percent. Let that number linger for a second. That’s not just a yield—it’s a neon-lit billboard screaming "Free Money!" at every income-starved investor on the planet. But as any good connoisseur of finance knows, when something seems too good to be true... it’s usually wrapped in options contracts.

So how does MSTY conjure this income magic?

The secret sauce is a synthetic covered-call strategy. In plain English: the fund buys exposure to MicroStrategy (MSTR) and then sells call options against it—collecting juicy premiums in return.

Those premiums are funnelled into cash distributions, creating the illusion that this ETF is a perpetual money printer.

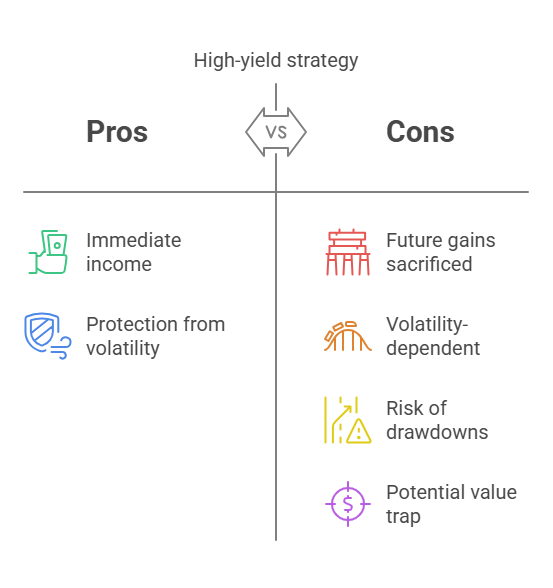

But here’s the kicker: high yield ≠ free lunch. That income? It’s your upside being sold off. MSTY trades future potential gains for present-day payouts. It’s the financial version of selling your surfboard to buy sunscreen—you’re protected, but you’re not catching any waves.

And sustainability? Well, let’s just say this strategy feeds off volatility. If markets calm down or options premiums dry up, so does the yield. If volatility spikes the wrong way, those premiums come with a side of drawdowns. It's high-octane income, sure—but you're always one Bitcoin crash away from watching your “dividend darling” morph into a value trap.

The MSTY Risks Rundown

If MSTY were a car, it’d be a turbocharged muscle car with no airbags. Flashy, fast, and occasionally wrapped around a tree. Let’s unpack the major risks lurking beneath that shiny performance hood below, but before we do, If you want a deep dive into a MSTY Risk Analysis, then have a read of my popular article - Counting the Costs: Understanding Risks in MSTY Yieldmax ETF Investment

Management Risks

MSTY isn’t a passive index hugger—it’s an actively managed ETF, meaning a real human (with a name and mortgage) is making judgment calls about options trades. That’s a double-edged sword.

Brilliant calls = big returns.

Bad timing = faceplants.

And unlike machines, humans get emotional, distracted, or worse—overconfident.

Volatility & Strategy Limitations

Let’s break it down: synthetic covered calls cap your upside while doing sweet bugger-all for your downside.

And since MSTY’s engine is MicroStrategy, and MicroStrategy’s engine is Bitcoin, you're basically strapping yourself to a crypto-rocket with a parachute made of tissue paper.

You’ll make money when it swings... until it swings the wrong way.

Liquidity Risks

Yes, MSTY boasts $3.28 billion in assets—a tidy number. But liquidity isn’t just about size; it’s about how easily you can get in and out without getting financially mugged.

During market stress, spreads widen, bids vanish, and you’re stuck holding the ETF equivalent of a screaming toddler in a shopping centre. Good luck selling.

Single-Issuer Exposure

Let’s not sugar-coat it: MSTY = MSTR = Bitcoin. It’s a single-horse race disguised as a fund.

If MicroStrategy tanks, so does MSTY. If Bitcoin implodes, you guessed it—double damage. Diversification? Not even close. This is concentrated risk in a tuxedo.

High Fees

You’re paying 0.99% annually for the privilege of this thrill ride. Compared to a plain vanilla S&P 500 ETF charging 0.03%, that’s a serious bite.

And while 1% might sound small, it compounds year after year, quietly eroding your returns like termites in a timber frame.

Drawdown Danger

In March 2025, MSTY took a nosedive—-40.82% peak-to-trough. That’s not just a paper loss; that’s a confidence-crushing, portfolio-wrecking moment.

These aren't abstract numbers—they’re real moments where real investors panic-sold or sat frozen watching their "safe income play" bleed out.

Emotionally? It's exhausting. Financially? It’s brutal.

Performance vs MSTY Risks: Key Metrics Recap

Let’s cut through the financial fog and get straight to the scorecard. Below are the hard stats—the numbers that matter, and the ones that should make you pause before hitting Buy Now on your trading app:

It’s a tale of extremes: sky-high yield, market-beating returns, and drawdowns that could knock the wind out of even the most seasoned investor. Think of MSTY like skydiving—exhilarating, profitable if done right… but not without the possibility of a hard landing.

Conclusion: Is MSTY Worth the Yield?

If you’re looking for a cushy, defensive play that gently grows your wealth like a bonsai tree—MSTY is not for you.

But if you're a yield-chaser with steel nerves, a high tolerance for volatility, and a strong understanding of options-based strategies, then MSTY might be your golden goose (with a side of hot sauce). It offers spectacular income potential, but only if you can stomach the wild swings and occasional gut-punch losses.

This isn’t your grandma’s ETF. It’s not a set-and-forget. MSTY is a calculated thrill ride, custom-built for the modern income junkie who isn’t afraid to dance with risk.

So, is it worth it? That depends on what keeps you up at night—missing out on big yield, or waking up to a 40% drawdown.

Choose your poison.

Resources and Further Reading

For those ready to dive deeper (or double-check the madness), here are your best sources:

- YieldMax ETFs – Official Site

Full breakdown of MSTY’s strategy, holdings, and distribution methodology. - TotalRealReturns.com

Honest performance tracking with YTD data and historical drawdowns. - StockAnalysis

Fee structures, dividend yields, and comparison tools. - ArmchairBanker

Sharp takes on management strategy, risk flags, and ETF comparisons.

Top 5 FAQ: YieldMax MSTY ETF

1. Is the 123.06% dividend yield real?

Yes—but it’s not magic. The yield comes from selling call options on MicroStrategy (MSTR), generating high premiums that are paid out as income. It's real, but it’s also risky, and not guaranteed year to year.

2. Can MSTY go to zero?

Not likely, but it can drop fast and hard. Since it tracks MSTR and MSTR is tethered to Bitcoin, a major crash in crypto could cause significant losses—just look at the -40.82% drawdown in March 2025.

3. How often does MSTY pay dividends?

MSTY pays monthly, which makes it attractive to income-focused investors. Just remember: frequency doesn’t mean stability. Payments depend on the options premiums it collects each month.

4. What’s the catch with that high yield?

The catch is capped upside and uncapped downside. By selling call options, MSTY gives up potential gains in exchange for income. If MSTR soars, you won't fully benefit. If it tanks—you feel the full impact.

5. Is MSTY suitable for long-term investors?

Only if you understand the strategy and have a high risk tolerance. It’s not a “buy and forget” ETF—it’s more like a tactical play for yield hunters who know how to ride the volatility dragon without falling off.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Medium - https://armchairbanker.medium.com/

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.