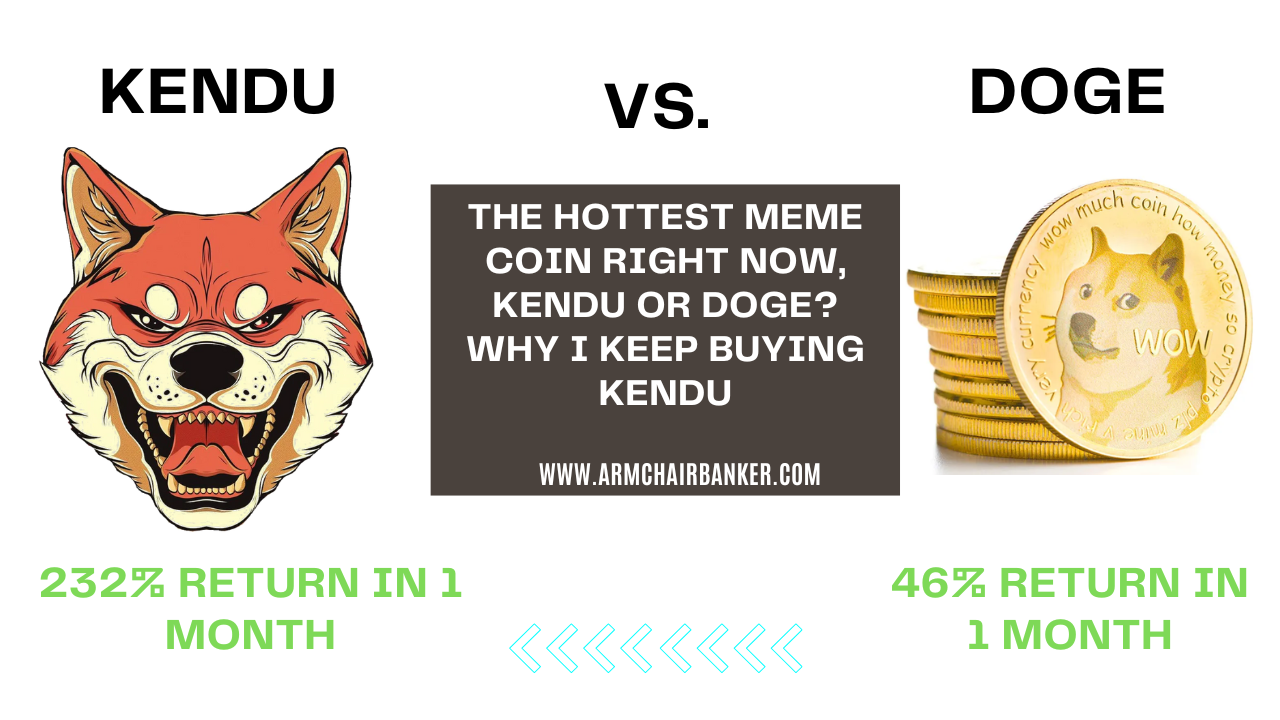

The Hottest Meme Coin Right Now, KENDU or DOGE? Why I Keep buying KENDU

Introduction: The Battle for Meme Coin Supremacy in 2025

Just when you thought meme coins had barked their last bark, 2025 proved otherwise—and louder than ever.

Despite ongoing regulatory scrutiny, the collapse of countless copycat tokens, and the maturing of DeFi protocols, meme coins are not just surviving—they’re thriving. Why? Because speculation is as old as markets, and nothing hits that dopamine button quite like a coin with a dog’s face and a chance to 10x overnight.

Remember my article in February Will Kendu Inu increase 1447% and Other Memecoins to Explode in 2025? I reckon this has aged like fine wine.

I’m currently holding 2 billion KENDU, and yes—I’m still DCA’ing in like a madman.

Insane? Maybe. Committed? Absolutely.

But truth be told, it’s the community that keeps me coming back—the memes, the momentum, the madness.

Now I hear you yelling:

“But Stevo! What are you on about? KENDU’s only up ~230% in May—not 1447%! Why are you still buying?”

Fair question.

So here’s the deal: I’m going to break it down—why I’m doubling down, the logic behind it, and how DOGE, the OG meme coin, stacks up as a benchmark.

Read on, legend. This rabbit hole’s got receipts.

In this year’s showdown, two meme titans have emerged from the chaos:

- Dogecoin (DOGE): The OG, the meme that became a movement, with the backing of Elon Musk and billions in liquidity.

- KENDU Inu (KENDU): A new, scrappy entrant delivering parabolic returns and catching fire across social media with all the speed and subtlety of a flashbang.

But which coin truly holds the crown in 2025?

In this article, we’ll dissect both contenders through four lenses:

- Performance

- Volatility

- Sentiment/Community (The secret sauce - you'll shocked)

- Market momentum

Whether you’re a degenerate trader or a curious observer, this is your front-row seat to the meme coin main event.

2. KENDU Inu: The Meteoric Rise of a Microcap

While DOGE still gets the headlines, KENDU has stolen the show in terms of raw return and social buzz. Born from the fertile chaos of meme coin culture and launched into the 2025 bull cycle, KENDU has proven one thing: in the world of microcap memes, speed beats size.

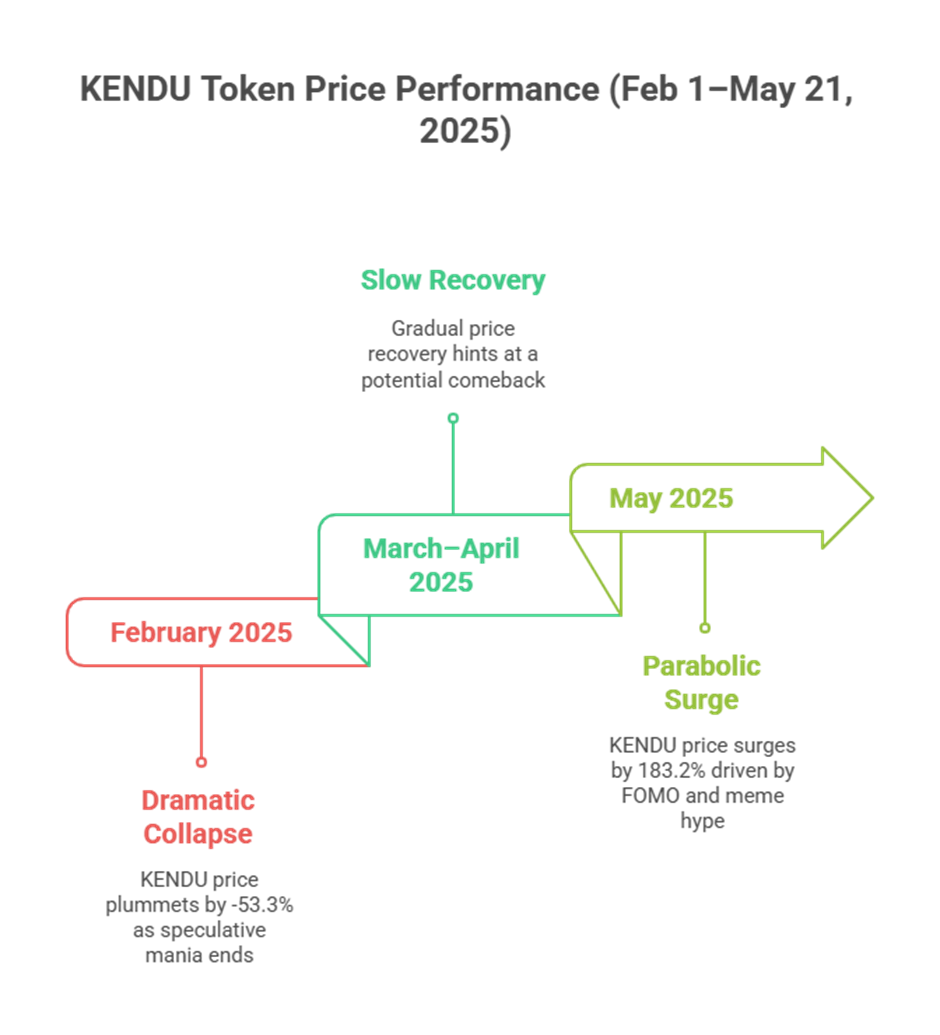

February–May Performance Overview

From February 1 to May 21, 2025, KENDU delivered a +66.3% total return, according to CoinGecko. But that’s just the headline.

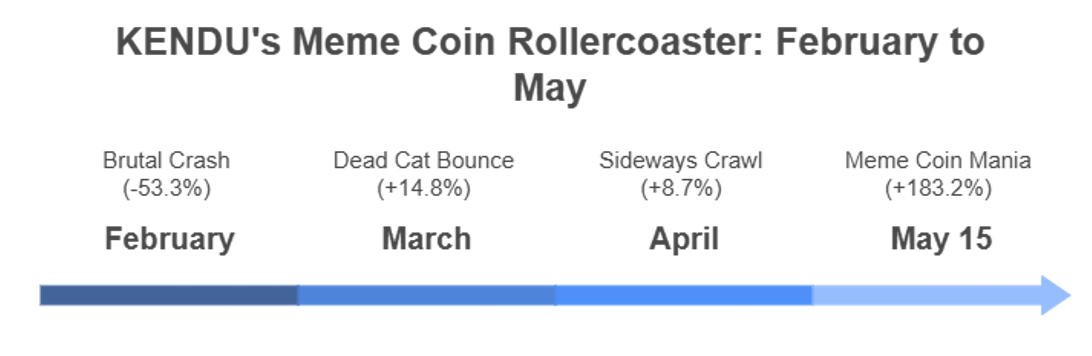

The path to that return was anything but linear:

- February saw a -53.3% collapse, as speculative mania dried up.

- Then came March and April, slow recoveries that hinted at a comeback.

- And in May—a parabolic 183.2% surge, triggered by renewed retail FOMO, TikTok meme hype, and classic buy-now-or-cry-later sentiment. But in Kendu’s case, I reckon it’s their relentless community, don’t believe me? Check out their reddit

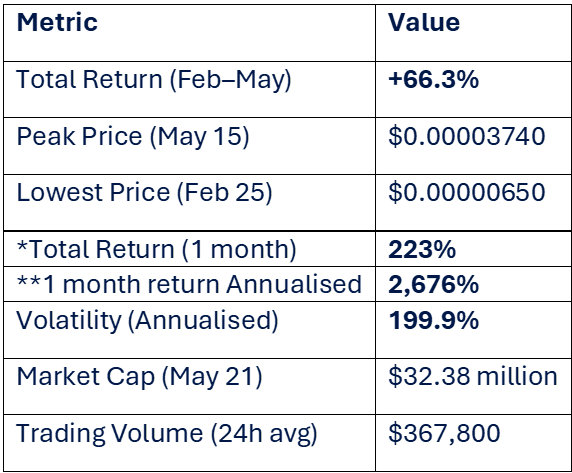

Key Metrics Table

Here’s how KENDU stacks up as of May 21, 2025:

Table breaking down Kendu’s ROI and Volatility

*Total return for 1 month = from 22nd of April 2025 to 22nd of May 2025 check it out on coinmarketcap. Let’s assume we continually achieve 223% each month (happy days) the annualised return would be 2,676% p.a. on a 200% volatility scale, big risk with potential big return.

That volatility? Nearly 3x Bitcoin’s, making KENDU a high-risk, high-octane ride suited only for those with iron stomachs and fast fingers.

Monthly Breakdown

Let’s break down the rollercoaster:

- February – Brutal Crash (-53.3%)

KENDU entered the month quietly and exited in a heap, mirroring the broader meme coin cooldown. It bottomed out at $0.00000650, the type of price that looks like a rounding error—until it isn’t. - March – Dead Cat Bounce (+14.8%)

As Bitcoin reclaimed $70K, meme coins got a tailwind. KENDU began crawling back, riding speculative optimism and bargain-hunter sentiment. - April – Sideways Crawl (+8.7%)

A month of consolidation. KENDU traded between $0.000012 and $0.000018, holding steady as traders waited for a signal. - May – Meme Coin Mania (+183.2%)

A full-blown moon mission. Backed by a resurgence in dog-themed tokens, KENDU exploded past $0.00003740 on May 15, hitting its all-time high before retracing slightly.

What’s Fueling the Hype?

Several converging forces turned KENDU from “just another meme coin” into a genuine trendsetter:

- 📣 Viral social campaigns

TikTok and TG communities created a grassroots firestorm, with “KENDU to the moon” posts spiking during the May run-up. - 🔄 DEX-focused speculation

With 98.8% of trading on decentralised exchanges, according to CoinMarketCap, KENDU trades in the wild west of crypto—where price discovery is brutal, and volume is king. - 🌐 Community-driven buzz

Memes, music videos, mascot wars—you name it. The KENDU community understood one rule: in meme coin land, attention is liquidity. And the new mantra “KENDU SENDU” – my personal favourite. Check out the craziness on their TG (telegram) or reddit page

3. Dogecoin in 2025: The Veteran Still Barking

If meme coins had a hall of fame, Dogecoin (DOGE) would be bronze-plated, framed, and installed in Times Square. Launched in 2013 as a joke, it somehow survived multiple crypto winters, regulatory threats, and Elon Musk’s tweets (the bullish and the bizarre).

Fast-forward to 2025, and DOGE hasn’t just survived—it’s solidified its place as the blue-chip of meme coins, with actual payments usage, massive liquidity, and a cultural brand that refuses to die.

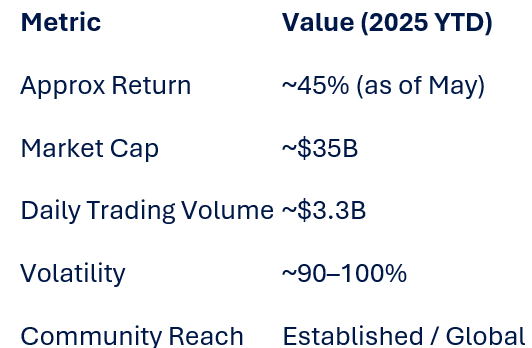

Year-to-Date Performance Snapshot

While KENDU sprints and staggers, DOGE jogs with consistency. As of May 2025:

- DOGE has delivered an estimated ~45% YTD return, according to data from CoinGecko and CoinMarketCap.

- It’s hovered between $0.10 and $0.47.

- Its volatility is tame by meme coin standards—around 90–100% annualised, compared to KENDU’s 199.9%.

And despite the rise of challengers, DOGE remains firmly in the top 10 cryptocurrencies by market cap, boasting a value of approximately $35 billion. Not bad for a coin featuring a grinning Shiba Inu and no hard cap.

Utility & Ecosystem

DOGE’s staying power isn't just about memes—it’s about usefulness.

- It's accepted by major retailers like Tesla, Newegg, and even AMC Theatres, thanks in large part to Elon Musk’s ongoing support.

- It’s integrated into X (formerly Twitter) for tipping and microtransactions, according to reports from Decrypt.

- And it’s often used for cross-border transfers thanks to its fast transaction speed and ultra-low fees.

In a sea of tokens promising ecosystems “soon™,” DOGE quietly delivers basic functionality now.

Then there’s the trust factor. DOGE’s brand is cemented in crypto culture. It’s survived booms, busts, and bear cycles. Investors know what it is, what it isn’t, and—critically—what to expect.

DOGE Metrics Comparison Table

With that kind of liquidity and brand equity, DOGE is no longer a joke—it’s the Coca-Cola of crypto memecoins.

4. KENDU vs DOGE: A Head-to-Head Comparison

With the introductions out of the way, let’s get into the nitty-gritty of what sets these two meme titans apart in 2025.

Price Performance

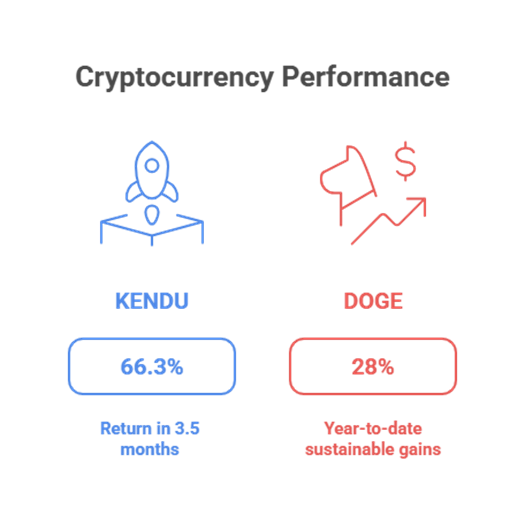

- KENDU turned heads with a +66.3% return in just 3.5 months, including a parabolic 183.2% run in May alone.

But the road to that return was paved with gut-wrenching drawdowns, including a -53.3% crash in February. - DOGE, by contrast, has offered steady, sustainable gains of ~28% YTD, behaving more like an altcoin ETF than a meme rocket.

👉 Verdict: KENDU is the sprinter. DOGE is the marathon runner.

Volatility Showdown

- KENDU’s annualised volatility is 199.9%, making it nearly 3x more volatile than DOGE. So in my opinion KENDU is 3x more exciting than DOGE.

- DOGE remains in the 90–100% range, relatively mild for crypto.

In short, KENDU is like crypto on a Red Bull binge. DOGE is sipping black coffee, nodding in the background.

Community & Hype Cycle

- KENDU thrives on next-gen virality—TikTok videos, TG raids, reddit community meme battles. Its following is young, chaotic, and momentum-fuelled.

- DOGE has a global, cross-generational fanbase, immortalised by internet history and constantly revived by Musk’s social media musings.

Both have cult followings—but DOGE’s is broader and institutionalised.

Kendu’s Secret Sauce – it’s community

What separates KENDU from the graveyard of forgotten meme coins isn't just the price action—it's the community.

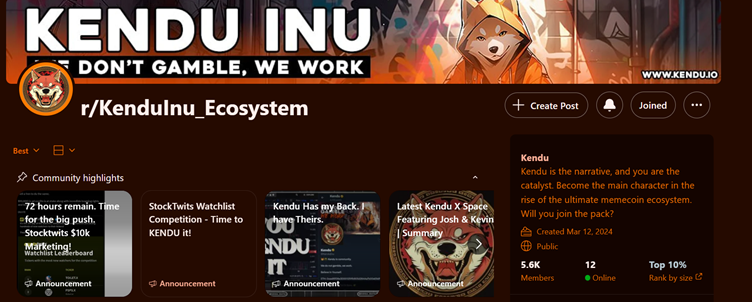

On platforms like Reddit, particularly in the r/KenduInu_Ecosystem subreddit, you’ll find a grassroots army of diamond-handed degenerates, meme lords, and surprisingly sharp market analysts all rallying behind the dog-themed digital underdog.

They’re not just posting price targets—they’re building lore, crafting memes, and coordinating social pushes like a decentralised marketing agency with nothing to lose and everything to meme. It’s fast, unfiltered, and fiercely loyal.

Unlike other coins that rely on celebrity tweets or pump groups, KENDU’s strength is bottom-up—driven by passionate holders who are actively creating content, onboarding new holders, and sharing play-by-plays of every price move like it’s a sporting event.

Whether it's rally cries like "KENDU to the Moon" or long-form breakdowns of future catalysts, this is a community with conviction. The vibe isn’t “hopium”... it’s “we’re building something chaotic—and maybe historic.” And in the meme coin world, attention is liquidity—and this crew knows how to generate both.

Here’s a snapshot of recent community efforts

🎮 Kendu Games: A BioWare Veteran Comes Out of Retirement—for a Meme Coin

This isn’t your average “web3 game.” One of the biggest announcements from the KENDU ecosystem is the launch of Kendu Games, a legit game studio started by community member Coop—with a former BioWare AAA developer leading the charge. Yep, the guy behind Dragon Age, Mass Effect, and Baldur’s Gate literally came out of retirement to build an RPG under the $KENDU banner. No crypto fluff, no cash-grab mechanics—just a full-scale Skyrim-style experience, followed by a roguelite in the pipeline.

Here’s the kicker: game profits will buy back $KENDU tokens and fund the community. The model? 10% of all profits go into a business treasury, and 5% flows into the community wallet. If they sell 1M copies (not unlikely with that pedigree), that’s $1.6 million in direct buy pressure on $KENDU—from one game alone.

🌍 Kendu Isn’t Just Digital—It’s a Decentralised Lifestyle Brand

KENDU is no longer confined to memes and price charts. It’s spilling into the real world—Kendu Coffee, Kendu Energy, Kendu Vodka, Kendu Nights (club events), even Kendu Esports. All of this was built by the community. No permission. No corporate gatekeeping. Just people taking the brand and running with it.

This is what true decentralised brand ownership looks like. Anyone can build. Anyone can contribute. That’s not just rare in crypto—it’s almost unheard of.

🛠️ No Speculation, Just Execution

KENDU isn’t built on hype cycles—it’s built on hustle. The community mantra? "We don’t gamble. We work." You’ll find token holders treating this like a startup: setting daily goals, launching products, dominating social content, and pushing for long-term growth.

Even more impressive? No paid influencers. No VC allocations. No insider dumps. Everyone buys with their own money and builds with their own effort. That’s how KENDU quietly hit 18,000+ holders—not from a hype pump, but from a work ethic.

🌉 Wormhole Bridge: Playing the Long Game Across Chains

While other meme coins play the short-term PR game, KENDU has already launched bridges to Solana and Base, positioning itself to top gainers lists across multiple chains. No flash, no announcement pumps—just quiet execution. And here’s a clever twist: if Solana rallies? KENDU’s price moves with it, thanks to bridge exposure. That’s passive upward pressure—without the buy-side friction.

TL;DR – Why I believe KENDU will be bigger than DOGE & keep buying more

- AAA dev building a full RPG under the KENDU name—with profits funnelling into token buybacks

- Community-led products already in the wild: Coffee, Energy Drinks, Vodka, Club nights, Esports

- No paid promos or insiders—just organic growth and real work

- Live on Ethereum, Solana, and Base, with cross-chain momentum baked in

- Still under the radar compared to other popular meme coins including $DOGE, $BONK and $POPCAT—massive upside from current levels

💥 KENDU isn’t just another meme coin. It’s a movement.

Liquidity and Exchange Risk

- KENDU is heavily concentrated on decentralised exchanges (DEXs), with 98.8% of volume flowing through platforms like Uniswap. That makes it vulnerable to slippage and thin order books, especially in a sell-off.

- DOGE, meanwhile, is listed on every major CEX—from Coinbase and Binance to Robinhood—making it one of the most accessible and liquid meme coins in the world.

👉 Verdict: KENDU is the underground mixtape. DOGE is on every radio station.

5. The Risk Factor: What Could Derail Each Coin

Before you ape into any meme coin, know this: these aren't investments, they're speculative combustion engines—and the fuel is hype. Both KENDU and DOGE carry their own landmines.

KENDU Risks

- 🚨 Thin Liquidity

With over 98.8% of KENDU’s trading on decentralised exchanges like Uniswap, it's vulnerable to major slippage and flash crashes. If a whale sneezes, your portfolio catches a cold. - ⚖️ Regulatory Grey Zones

KENDU, like many microcap tokens, operates in the wild west of regulation. If a jurisdiction suddenly clamps down on meme coin marketing or DEX activity, it could vanish faster than you can say “rug pull.” - 🌀 Purely Narrative-Based

There’s no staking, no DeFi utility, no roadmap—just vibes. That means when the memes stop, the momentum dies with them. BUT, on the other hand, Kendu’s community is continually growing and during it’s darkest days the social raiding and organic shilling never stops.

DOGE Risks

- 😴 Sentiment Fatigue

Even the strongest memes fade. After 12 years of existence, DOGE’s novelty is wearing thin for newer traders, who now gravitate toward flashier, riskier projects. - 🐶 Over-Reliance on Elon Musk Tweets

When Elon tweets, DOGE moves. But when he doesn’t? The market snoozes. That’s a shaky foundation for a $12 billion asset. - 🔧 Lack of Technical Evolution

Compared to modern altcoins with smart contract functionality, ecosystems, and NFTs, DOGE feels... flat. There’s been little innovation since its inception, aside from minor dev updates and merchant adoption.

My Expert View: What Matters More in 2025—Volatility or Viability?

Here’s the truth from someone who’s navigated both capital markets and crypto trenches:

Volatility is sexy. Viability is profitable.

As an Aussie investment banker, I’ve seen speculative bubbles inflate (and implode) across sectors, I’ve learned that meme coin investing isn’t about models or fundamentals—it’s about momentum.

- KENDU is the trader’s dream: parabolic potential, fresh narrative, and huge upside... if you’re fast.

- DOGE is the investor’s hedge: stable enough to trade like an altcoin ETF, liquid enough to exit without panic.

In this market, some chase 10x returns. Others want exposure without the whiplash. The real question isn’t “which is better?” but “which is better for your temperament?”

7. Conclusion: So, Who’s Hotter—KENDU or DOGE?

Let’s break it down:

- 🔥 KENDU is hotter in 2025 by pure numbers: +66.3% in under 4 months, 183.2% surge in May, and front-row status in the meme coin hype cycle.

- 💎 DOGE is steadier, more trusted, and deeply embedded in the crypto zeitgeist with institutional exposure and a loyal global fanbase.

So... who wins?

That depends.

If you're chasing the moon, KENDU’s your ticket.

If you're trying not to crash into it, DOGE might be the safer orbit.

In meme coin land, you’re not buying assets—you’re buying stories. Choose the one you’re willing to hold through the next plot twist.

8. Sources & Live Data Links

- 📊 Kendu Inu on CoinGecko

- 🐕 DOGE Market Data

- 🌍 CoinMarketCap – Global Crypto Stats

- 📈 Kendu Historical Data – CoinGecko

- https://www.reddit.com/r/KenduInu_Ecosystem/

- February Article Will Kendu Inu increase 1447% and Other Memecoins to Explode in 2025?

FAQ: KENDU vs DOGE – What You Need to Know

1. Is KENDU Inu a safe investment?

No meme coin is “safe.” KENDU is a high-risk, high-reward speculative asset with extreme volatility and low liquidity. Its price movements are driven more by social sentiment than fundamentals. Proceed only if you’re comfortable with rapid swings—and potentially losing your full investment.

2. How is Dogecoin different from KENDU Inu?

Dogecoin has wider adoption, greater liquidity, and mainstream visibility, including listings on Coinbase, Binance, and Robinhood. KENDU, on the other hand, is a microcap coin mostly traded on DEXs and lacks utility beyond hype. DOGE is the veteran; KENDU is the upstart.

3. Why is KENDU so volatile?

KENDU trades primarily on decentralised exchanges and has a small market cap, making it sensitive to sudden inflows or outflows. Its 199.9% annualised volatility is nearly triple that of DOGE, meaning sharp price swings are the norm—not the exception.

4. Can DOGE still deliver big returns in 2025?

While DOGE has already matured as a meme asset, it still benefits from widespread community support and Elon Musk’s occasional endorsements. Its upside may be more limited than smaller meme coins, but it remains a strong player in the meme coin ecosystem.

5. Which coin is better for short-term traders?

If you’re chasing fast gains and can stomach high risk, KENDU’s explosive price action may appeal to you. If you prefer more liquidity, easier exit strategies, and brand stability, DOGE might be a better fit. It all depends on your trading style and risk tolerance.

Cheers,

Stevo – Armchair Banker MAppFin, AdvDipFP, ADA

‘Meet Stevo, the financial wizard behind Armchair Banker. With 15 years of experience in investment banking, corporate finance, and markets, Stevo’s résumé is so impressive it could intimidate a spreadsheet.’

For more ‘Ah-ha’ money and finance guides visit www.armchairbanker.com and subscribe to our newsletter

Follow us on socials

X - https://x.com/armchairbankr

Facebook - https://www.facebook.com/armchairbanker

Full Disclosure: Stevo may or may not hold this asset at the time of publishing. Using my provided links/affiliate links could result in a payment or fee discount for Stevo, helps keep the lights and refill his whiskey on the rocks mate.

DISCLAIMER: The information in this article does not constitute personal financial advice. Consult your adviser or stockbroker prior to making any investment decision.

MORE DISCLAIMERS: Stevo is not a Financial Adviser, however, works as an Investment Banker assisting ASX listed companies with retail capital raises. All opinions expressed and written by Stevo, including all other ‘Armchair Banker’ contributors is for informational and entertainment purposes only and should not be treated as investment or financial advice of any kind. Any information provided from our articles, blogs and written opinions is general in nature and does not take into account your specific circumstances. Armchair Banker and its contributors are not liable to the reader or any other party, for the reader’s use of, or reliance on, any information received, directly or indirectly, from any content by Armchair Banker in any circumstances.

The reader should always (we’re serious about this):

1. Conduct their own research

2. Never invest more than they are willing to lose

3. Obtain independent legal, financial, taxation and/or other professional advice in respect of any decision made in connection with this video/article.